The dreaded federal income tax season for 2011 has arrived once again. Just as people have feared and hated to pay taxes centuries ago; people still fear and hate paying taxes nowadays. However, unlike hundreds of years ago, there are now ways to actually get refunds for some of the taxes you have paid throughout the year. Here are some tips on how to file your tax return and wisely spend your refund, if you are entitled to one.

Tips for filing returns

The first tip for filing your tax return is to file it electronically instead of by mail, whenever possible. There are a few circumstances that make it not possible, such as taking the tax credit for purchasing a new home in 2010. However, the majority of American taxpayers can avail themselves of online electronic filing systems. Electronic filing system makes filing a return more convenient. In many cases, it’s less expensive if the person prepares his or her own tax return. The online wizard guides help the taxpayer to find deductions and credits that they may not have known about otherwise.

The electronic filing systems also allows more time for procrastination. It has been estimated that approximately 27% of American taxpayers procrastinate filing tax returns each year. Procrastinators will appreciate the online filing even more this year, since there will be fewer post offices staying open late for last minute filers.

The second tip is to file you taxes early, even if you owe money. You can have the IRS payment scheduled to be taken out on its actual due date, rather than on the date you file the return. Normally this would be April 15th, but for 2011, the payment due date is April 18th. Apparently Emancipation Day is a celebrated Washington, D.C. holiday, and is supposed to be celebrated on April 16th. However, since it falls on a Saturday this year, the government is taking the Friday before it off, which means they won’t be open on the day the taxes are normally due. So procrastinators will have three extra days this year. This also extends the cutoff deadline consideration for setting up an IRA account or for contributing to an existing one.

The third tip is to file a request for an extension on IRS Form 4868 by April 18th if you need more time to get your documentation together. The extension will not give you more time to come up with any money you owe the IRS, but will give you an extra six months to provide support for any claims you’re making. You will still have to pay the federal and state income taxes by their original due date. However, if you can’t come up with the total sum, you can usually work out a payment plan with the IRS. If you don’t pay the money owed on time, then you will probably incur interest charges and possibly incur a penalty as well.

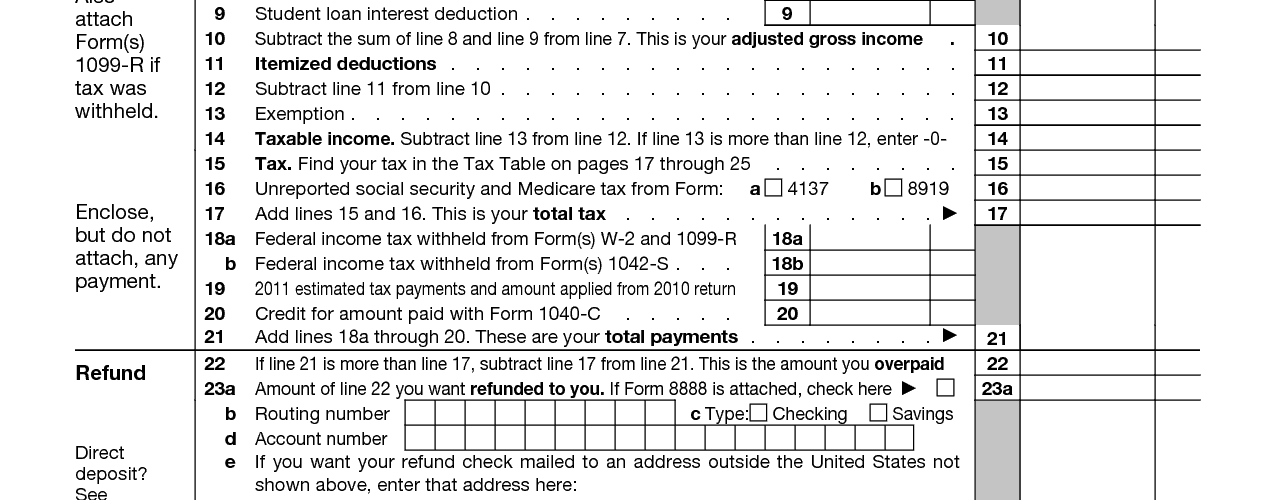

Another tip for filing returns is to avoid the most common mistakes by double checking the information entered. The most common mistakes made are incorrect or missing Social Security numbers, missing signatures, missing dates, and mathematical errors. So even if you’re in a hurry, make sure each bit of information is correct and placed on the right line.

The final tip is to make sure you have applied for all the credits and deductions you are entitled to. If you aren’t sure what they may be, then seek advice from an accountant, a professional tax preparer, or an IRS tax assistant. This year, tax credits are being bestowed on adoptive parents, college students, certain working taxpayers, and energy-conscious people.

Tips for spending refund

The average American taxpayer will receive a refund of $2,000-$3,000 this year. Many people will spend their refunds quickly through splurging on whatever grabs their attention. However, financial advisors suggest using the refunds in better ways. They suggest you spend your refund on:

- Buying life insurance

- Opening or contributing to an IRA account

- Setting up an emergency fund or savings account

- Investing in stocks, bonds, or CDs

- Setting up or adding to a college fund for your child’s education

- Improving your employability by taking training courses, increasing job skills, getting official certifications, or joining professional associations

- Improving your long-term health, which will save you lots of money over time

- Paying off a loan early, or at least applying it to the principal balance of a high-interest loan or credit card debt

- Buying something that will save you money later, such as energy-saving technology and home improvements

No matter how much the tax season is hated and feared, it offers the taxpayer many opportunities as well. The taxpayer has an option every year on how much taxes will be withheld during the year. The person can choose to have more or less money withheld each pay check, simply by filling out a W-4 form. The person can choose to overpay the taxes during the year in order to get a large refund at the end of the year. The person can also choose to underpay during the year and then pay the IRS money at the end of the year. Or the person can use the W-4 to have exactly the right amount taken out each payday, and not have a refund or owe the IRS at the end of the year. Getting a refund gives the taxpayer a choice every year whether to invest it in ways of making more income over a long term or splurging it on having fun for a short time.

<>