The process of looking for and buying a new house is an exciting one. Many people make the mistake of searching for their new home without even knowing how much they can afford to spend. When this happens, it often ends up leaving the buyer frustrated over time wasted and expectations not reached. It is a good idea to get informed, before you shop around, how much money you can afford for your home.

There are many different variables when determining the amount that you can spend on your home. Some things to take into consideration are your income and the amount of cash you can allocate to the transaction. Mortgage terms available at the time you are looking to buy is also something that is needed to be looked into. Mortgage terms include interest rates, points, term, amount required for down payment, and the maximum ratio of income to housing expense. Other factors to consider include your existing debt and the closing costs, which vary from state to state.

Contents

Qualifying For A Mortgage Loan

The lender looks at different factors before qualifying and approving a borrower for a mortgage loan. A “good loan” is a loan that has a small risk factor to it. This is determined by both the ability and the willingness that a borrower has to pay off the loan. The ability to repay is called “qualification” and the willingness is determined by the borrowers credit history. When the lender makes the final decision to approve or deny the loan, it is called “underwriting.” In order for the loan to be approved, the creditor must be satisfied that the borrower has both the ability and the willingness to repay.

Meeting Income Requirements

Two questions are asked when determining the borrowers ability to pay. First, is the borrowers income large enough to pay the house expense, as well as any existing debt obligations. Second, does the borrower have enough cash to meet the needs of the transaction? Such as down payment and closing costs. The lender needs to be satisfied with both answers in order to approve the loan.

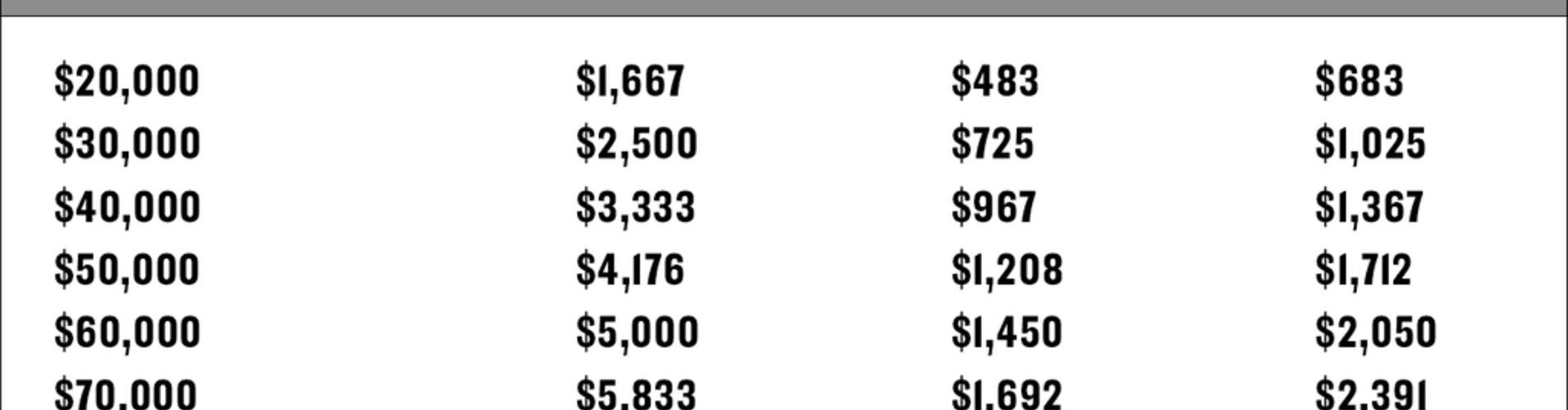

Lenders assess the borrowers income according to two main ratios that are standard in the trade. The first is called the “housing expense ratio” which is the sum of the monthly mortgage payment, this includes mortgage insurance, property taxes, and hazard insurance. The lender takes this sum and divides it by the borrowers monthly income. The second ratio that the lender looks at is called the “total expense ratio.” This ratio is the same as the first, only it adds in any existing debt obligations that the borrower is under. Every loan program has a maximum percentage set for these ratios, for example 28% and 36%, which the actual ratios must not exceed.

Meeting Cash Requirements

Most borrowers have more limitations in the amount that they can spend on a house because of issues meeting the cash requirements, instead of the income requirements. Cash is needed when buying a house to meet the down payment, the settlement costs, title insurance, escrows, and a variety of other charges.

The amount of cash needed for a down payment will be higher if the lender feels your loan has characteristics that are risky. Such cases like this may include a poor credit record or when the borrower is purchasing the house as an investment instead of to occupy it. The down payment will also be higher if the loan is a larger one.

One main point to be aware of as far as cash availability would be that lenders look for borrowers who can pay the down payment with funds that they have saved. This shows the lender that the borrower has the discipline to save, which looks well for the repayment of the loan. On the other hand, lenders do not like when the borrowers have to get help for the down payment, such as from family or friends. This shows that the borrower has yet another debt to repay and may affect the ability to pay the mortgage. If you do need to borrow it is a good idea to have the money in your bank account for several months before applying for your mortgage loan.

A mortgage calculator is also a good tool to use to get an idea of how much your monthly payments will be.

Related Posts

- How to Get Pre-approved for a Mortgage?

- How to Remortgage?

- Credit Disputes to Affect 2012 FHA Mortgages

- How to Reduce Mortgage Payments?