When you are in desperate need of fast cash, you may not have many options available to you. You may have a bad credit score, and are wary about asking a bank for a loan. That’s when no credit check unsecured loans can be a lifesaver for many. With these types of loans, you are able to get the money that you need, quickly and easily, without ever submitting to a credit check.

Unsecured no credit check loans are also called payday loans, cash advances, online cash loans and more. However, they generally have one thing in common- you don’t need good credit to be eligible, and you are not required to put up any type of collateral, hence the name unsecured. You are only required to meet a few simple specifications in order to get your loan, and many people already meet them.

How Much Can be Borrowed?

One of the biggest and most asked questions concerning no credit check unsecured personal loans is this- how much can I borrow? There are a few factors that will determine this answer. The state regulates these types of unsecured loans, so depending on where you live, there may be a cap on how much you can borrow. Generally, payday loan companies offer their borrower’s loan amounts from $100 to $1,500, which again, will vary according to the state. Another factor is how much you make at your current job. The more you can account for, the more you will probably be able to borrow.

Finally, the individual company may have their own specific rules as to how much they lend their customers. Some companies will start new customers out with a lower loan to ensure that they are reliable and will pay it back. Once they do, the company will gradually increase how much can be borrowed each time a new loan is taken out. All of these factors together will determine the amount an individual may borrow.

There’s Really No Credit Check?

Many first-time borrower’s can’t believe that someone will give them a cash loan, even without a good credit score. But it’s true. Unsecured loans with no credit check are developed so that anyone can borrow money, despite having either no credit or bad credit. When you apply for a loan through a traditional banking institute or a credit union, the company will run a credit check to see if you qualify. Even an average score may keep you from receiving a loan in many instances. With cash advance companies, it’s never a problem, as the company will never need your credit score to approve you for a loan.

It is important to remember this, however- many companies will look to see if their customers owe money to another payday loan company. If you have an outstanding debt for another payday loan, you may very well not be eligible for a new one. Pay off your old debts first to ensure that this is not a problem.

What’s The Process?

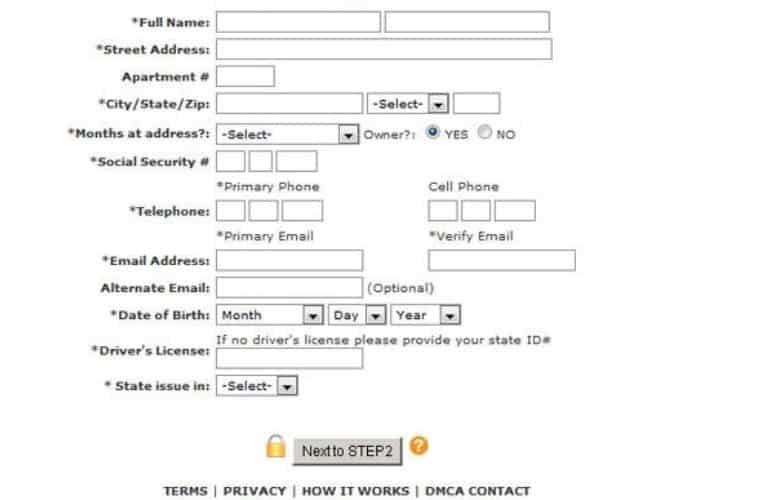

The application process for payday loans are very simple. You will be asked to fill out your personal information, such as your name, address, social security number, telephone numbers, etc. Next, the company will require your employment history. You may need to be employed with the same job for a minimum amount of days to get a loan, usually between 30 and 60. This will vary according to the company. Finally, your banking account information will be needed. This is so that your loan can be deposited right into your banking account. Be sure that you have all the correct numbers when you fill out your application, to avoid errors in receiving your money.

When you pay your loan back on your next payday, which is the standard procedure for most companies, they will withdraw the money right out of the same account that you received it in. Remember that all applicable finance fees will also be withdrawn along with the principle loan amount. Make sure that you can pay back what you borrowed before applying for a loan.

An unsecured loan can help anyone out in a troubling financial time. Don’t hesitate to apply today for the money you need now!

<>