If you want a new vehicle, an individual just does not purchase the first car you run across. An individual of course would shop to uncover the best deal possible. You need to stick to the same wise shopping strategy when searching for a low cost personal loan. Rates of interest, fees and repayment preferences can vary from loan company to loan company and from personal loan to personal loan. Look at a number of lenders prior to deciding on a low cost personal loan.

Contents

These are some potential questions to ask your prospective lender:

What are you being charged for an interest rate?

How much will my monthly payments be and for how long?

Over the total life of this loan how much interest will I pay?

Will there be a fee if I pay off the loan early?

Will there be origination fees, late fees, application fees?

Methods Of Payment

Does the lender offer you a number of different pay methods such as payment by phone, online payments, check payment, credit card, direct debit from my checking account? Does the lender attach a fee to any of these different payment options?

The purpose of shopping for the best top level loan with the best terms and conditions is essential because you could save a lot of money just by shopping carefully. Selecting a shorter term for your personal loan may also assist you to lower how much interest you pay out.

Finding the Loan That Fits

The important thing to remember is to make sure you find a personal loan that works perfectly within your budget. One that lets you easily make all your payments on time and in full each and every month so you can maintain a excellent credit rating.

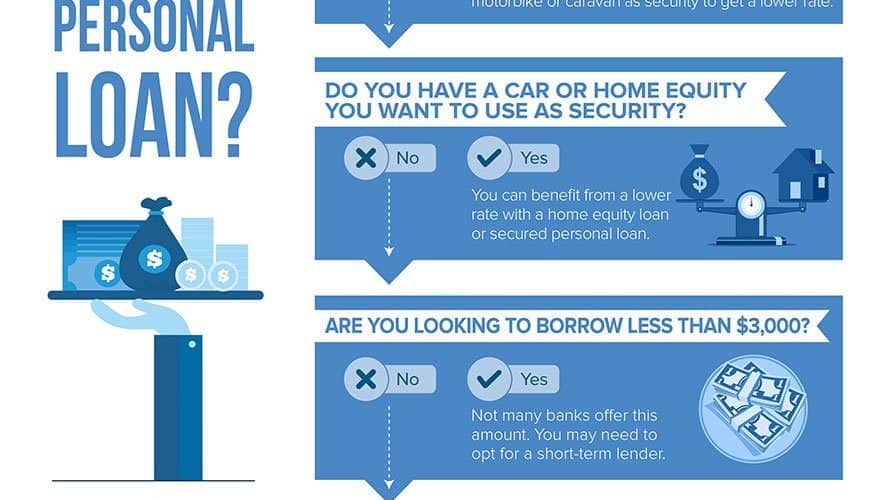

Differences Between Secured & Personal Loan

Whenever you sign up for a secured loan, you need to back up your assurance to pay with an object of value, for instance your car or home. In the event that you do not pay your secured loan off in full and on time, the lending company will take possession of the item of value you promised as security. The pledged item of value is known also as collateral.

A individual personal loan, on the other hand, doesn’t need collateral.The only thing the loan company needs for a personal loan is your signature on the loan contract. In this loan deal the lender will face a larger amount of risk than usual. In the event that you do not pay back your loan, the loan company has nothing of value in order to replace the loss. Due to the increased risk the interest levels on low cost personal loans in many cases are higher than on the majority of secured loans.

It would seem that not repaying a personal loan is much less significant than not paying back a secured loan making it possible to lose your house or car. However you do have something of value in play here that is a little more subtle than you make think. You can do serious damage to your credit rating that will make if tougher to get a car loan or a house mortgage when you need it in the future if you do not repay on time and in full.

Realizing Some Facts

Poor credit can make a difference in your potential to acquire funds in the future, to be eligible for a credit card, to be taken into consideration for a job, and to have the ability to rent an apartment or a home.

Take the following simple steps to protect your credit rating:

Only borrow money when you need to and will be able to repay on time and in full.

Only borrow on items that are essential to your needs.

If you can save up for the item it is better than going into debt unless you need to build your credit rating.

Do your due diligence, find the best deal possible, compare interest rates, fees, terms, before making a decision.

If you do not understand something make sure to ask questions.

Know exactly what you can afford and do not go over budget.

Conclusion

It would be advisable, unless you absolutely need to borrow for a good credit rating, to save up for the item you want to purchase and pay for it in full. If you are married you and your wife can save up for the item of purchase with your two separate paychecks. The purchase money will build quicker and easier this way and will keep you out of early debt. This can be the source of much friction in a marriage and why take the chance when you can pay for an item in full. In a recession, like we are in today, why pile on unneeded debt when you do not have to. Living frugal pays off in the long run, only borrow when absolutely necessary.

<>