When it comes to auto insurance, some groups are considered a higher risk while others constitute a low risk for claims. People over fifty are considered a low risk group and may find that their insurance premiums are much cheaper than those for people under 25. Drivers under 25 have higher accident rates and make more insurance claims; because of this they must pay higher prices to have their vehicle insured. Even good drivers looking for under 25 car insurance have to pay these higher premiums.

If you are under 25, you need to be aware of the various factors that affect the cost of your insurance. Knowledge of these factors may help your rates. The first thing you must do is compare and shop around. This sounds very basic, but it is essential. Go to an insurance quote site online and fill in all the required information. You will then receive e-mails and phone calls from insurance agents with a variety of carriers. It is recommended that you fill in your information on three different sites as this will give you a comprehensive picture of your potential premium rates.

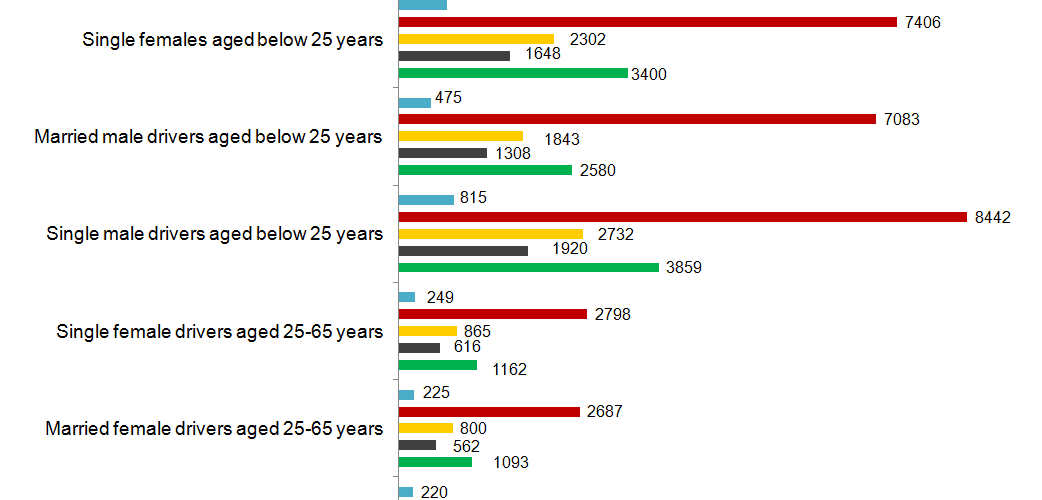

There are numerous factors insurance firms look at when determining insurance rates for those under 25. If you are single, you will most likely pay more than if you are married. Insurance firms recognize that married people tend to take less risks than those that are single. If you are a male, you will pay more. Why? Because you tend to drive more and be more reckless than your female counterparts. If you buy a sports car, perhaps a Mustang convertible, or a Camaro, expect to pay more for your premiums. Living in a big city will get you higher premium rates. A 21 year old single male who buys a Mustang convertible and lives in Los Angeles will have a hefty insurance bill.

The most obvious factor that affects insurance rates is driving record. Even if you are in one of the lower risk groups, a poor driving record will cost you. An accident or two plus a few speeding tickets will cause your premium rate to skyrocket. The insurance carriers utilize actuarial tables that detail the higher rates for accidents and tickets for people under the age of 25. They can justify these higher rates with real statistics.

There are a few discounts to look for when considering the purchase of auto insurance. You should look at what coverage you need. You can reduce your premium by purchasing coverage with a higher deductible. The deductible is the amount of money you would need to pay, in case of an accident or claim, before the insurance carrier becomes responsible. Getting a policy with a $500 deductible will save you money over a policy with a $250 deductible. If you have an older model car, consider buying only the essential coverage. If the cost to replace your vehicle is insignificant, skipping the collision coverage will save you money.

If you are student, maintaining good grades, usually a B or above, will save you a possible 10 – 25 % with some insurers. Taking safe driving courses may also make you eligible for discounts. Some insurers recognize the benefits of these classes. These courses not can save you money, they can save your life as they focus on defensive and safe driving techniques. Make certain that the course is approved by your insurance carrier before signing up. You may also pay less on your premium if you pay it in full. There are often billing fees if you pay monthly or quarterly.

Car insurance for under 25 is expensive; there is no way around the fact that you will be paying plenty of money for the privilege of driving. Discounts are available and they will save you money. Educate yourself on the discounts, compare prices from several firms, and most importantly, maintain a clean driving record.

<>