A new report was just released by the National Association of REALTORS (NAR). According to the report, existing home sales declined in May. Although the US housing market is still struggling, this isn’t the only reason for the decline. The real reason is, there just isn’t enough homes available to buy.

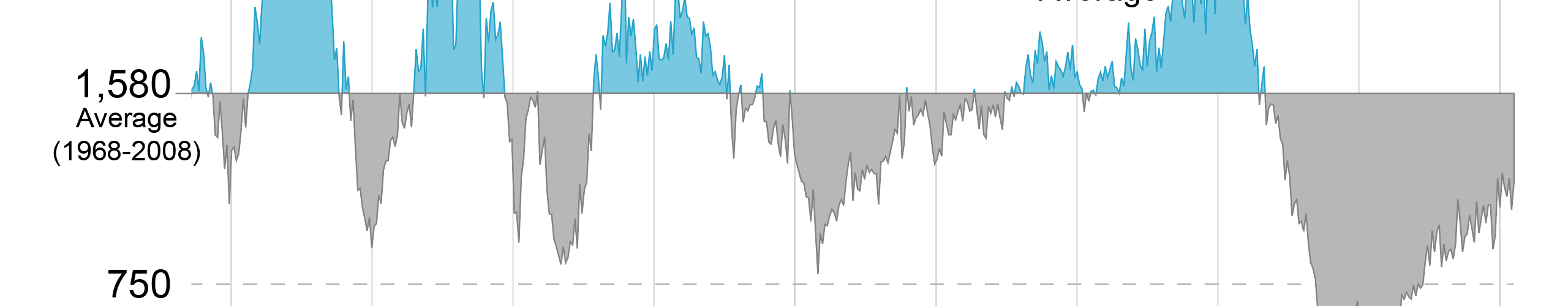

The amount of homes for sale has decreased by 20 percent in the last year to just 2.49 million. The lowest supply is of low-end homes, which are what investor seek to make a profit. Those are also the homes most buyers are looking for in order to be sure they can afford their mortgage payments. The low supply is having a major impact on homes prices for the second month in a row.

NAR Report Statistics

The NAR report shows that existing home median prices went up in May by 7.9 percent since May 2011. Lawrence Yun, the chief economist for NAR made sure to point out that this doesn’t mean that homeowners have gained the same amount of equity in the past year. It just reflects that the type of homes buyers are purchasing has changed. Homes that sold for under $100,000 decreased by two percent from the same time last year. However, homes that sold between $250,000 to $500,000 increased by almost 29 percent, although the volume is still historically low. This is because of the lack of homes for sale on the low-end, namely distressed homes.

Currently, many homes that are in foreclosure status and those with delinquent mortgages still exist. A new Lending Processing Services report shows that the number is 5.57 million. They say that the big banks that service these loans are still attempting to backtrack and modify a large amount of these loans. But, a very big foreclosure backlog still exists in judicial states such as New York, Florida and New Jersey. Non-judicial states are those that don’t require a judge to complete the foreclosure process. In these states, such as Arizona, the foreclosure backlog has gone down to less than a three-month supply.

In the past, there has always been a bump up in home supply during the spring. But, Realtors have reported that this didn’t happen this past spring. Less than the usual amount of homeowners put their houses up for sale this year. Many people are asking, why? According to Freddie Mac, mortgage interest rates dropped again to 3.66 percent on conventional 30-year fixed-rate mortgages, hitting a record-low again.

Supply Factors

Home prices are becoming more stable in some markets, and increasing in others. The low supply should be an indication to owners that their homes could get multiple offers, starting a good bidding war. Yet, the supply is still not meeting the demand. Yun believes that this is because many homeowners believe the best way to help the housing market recover is to hold on to their homes throughout the market’s struggle.

Other factors include fear and upside down mortgages. Somewhere around 12 million homeowners currently owe more on their mortgages than their homes are worth. That means that selling won’t make them a profit. Many will come out still owing in the end. They don’t even have enough equity to cover moving costs, Realtor fees or a down payment on another home. These factors make this a great market for first time homebuyers, according to NAR. But, only 34 percent of home sales represent first time buyers. In the past, before the housing crisis began, this group made up 45 percent of homebuyers. The reasons: fear and credit issues. Qualifying for a mortgage is nowhere near as easy as it used to be.

In Northern Virginia, the supply-and-demand issue is so bad that their Realtors launched the “Ask Me” campaign earlier this week. The campaign is an active attempt to get potential sellers to simply call agents just to find out if now is a good time for them to sell their homes and buy another one.

There is currently no more than a two-month supply of homes for sale in the North Virginia market, according to the Northern Virginia Association of REALTORS (NVAR). This is a 37 percent decrease from the same time in 2011. Unemployment is getting better, helping sellers to obtain 97 percent of the list prices of their homes. But, the supply is still extremely low, while the demand is higher than ever. Realtors are finding themselves begging homeowners to help with the supply.

The New Housing Crisis

The low supply is now the latest crisis in the housing market. It shows how unique the market recovery is in the US. Unlike in the past, the recovery is now more dependent on the activities of investors, not on typical selling and buying better homes. Investor purchases equal one sale. However, regular sales usually equal two or more. That’s because most sellers go out and buy another home. And, that seller buys another, continuing the trend.

Investors are an important factor when it comes to helping the housing market recover from the crash. But, more actual sellers are needed in order for the recovery to make a complete turnaround in the market. Only time will tell. In the meantime, though, this is the new housing crisis. There’s just not enough supply to meet the current demand of homes for sale, especially in the low-end housing market.