How much of a house an individual or family can afford used to follow a common formula used by lenders. It is still used by lenders, but with salaries for the most part not keeping up with inflation, and the advent of differing mortgages (adjustable types and 40-50 year fixed styles), this formula is not set in stone. With the drop in house prices, and the need to try anything to get someone into a home, the formula is again becoming important.

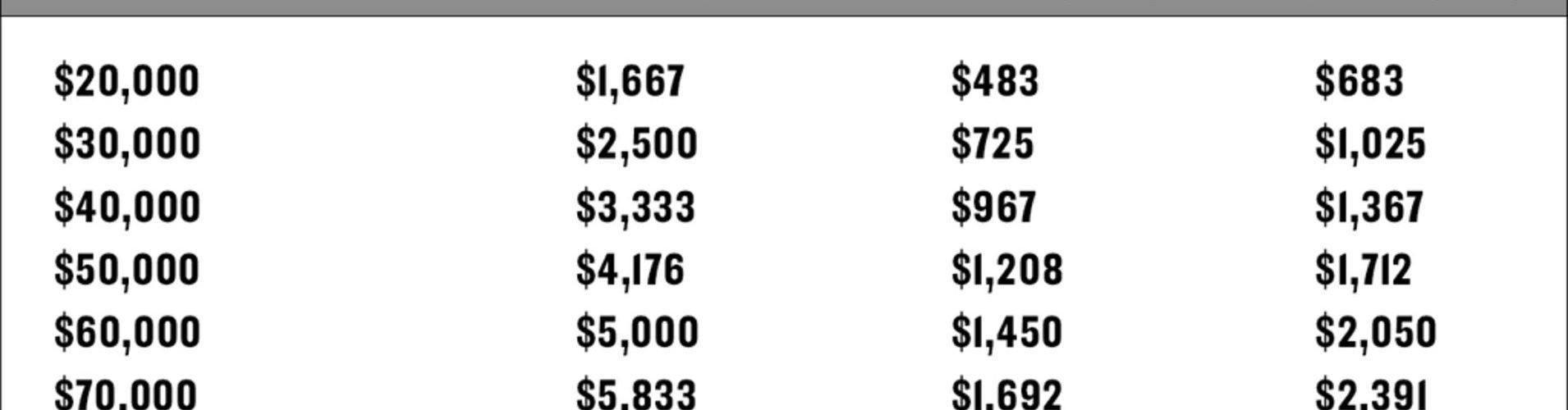

The formula was a debt to income ration of 36%. This means your total debt does not exceed more than one-third of your income, more or less. This is total debt including car payments. Another formula is the house payment to income ratio of just under 30%. Of course this would have to take into consideration how responsible the people are in paying down debt. A FICO (Fair Isaac Corporation) score by the 3 credit rating agencies is another tool used by the lenders. The problem with the FICO score is something called a thin file and thick file.

A FICO score of over 750 is considered very good to excellent. But, if this score is derived from a thin file, which means there is not much history in borrowing or credit, it can be deceiving. Someone who has a slightly lower score, but more of a credit history, would be a better risk. Many of the criteria determining the buyer’s eligibility for a loan are subjective. Another thing to keep in mind is that the 3 credit rating agencies, TransUnion, Experian and Equifax could issue ratings that are quite different.

This criteria was entirely disregarded in the last few years, which helped to lead the country to the housing and banking downturn. It sometimes takes a perceptive lender, who is honest and wants to make a loan that will be paid back, to determine fairly who can afford a home.

The price of the home with the aforementioned formula is but a guide. If you like to eat out a lot and spend money on the newest items that you do not really need, this should be taken into consideration when purchasing a home. Your home is the largest investment you will make, and the monthly mortgage payment must be made first. You do not want to risk losing the home through foreclosure, like many are going through now.

Taking a fixed rate mortgage will give you the exact amount you need to pay each month. The insurance and taxes, which are paid along with the mortgage will rise, but not the mortgage itself. The fixed rate mortgage will not put pressure on you to earn more money in case the adjustable mortgage rises, and it will in the near future when inflation finally gets traction.

An important item to have before purchasing a home is a “rainy day fund.” This will pay for the home until you get another job or help pay medical expenses and for other unforeseen eventualities. The higher the mortgage, the more money required. Nevertheless, at least 6 months of mortgage payments must be available by setting it aside.

When figuring how expensive a house to buy, ask yourself a few questions. One would be do I need such a large home, and must I pay extra to live in an exclusive neighborhood. Every person is different, and an honest self-analysis of spending patterns is necessary. A lender cannot get inside of your head.

It is best to do all figuring on the conservative side. It is preferable not to put a marriage under pressure with the ability to pay the mortgage. It is a good idea to have money left over each month, then cut it razor close. Negative eventualities should not be brushed aside, but kept in mind so as to give the home buyer a cushion in paying the monthly mortgage. With taxes rising in order for municipalities and towns to meet their obligations, the cushion will decrease.